Antigua and Barbuda’s Parliament has approved the _Eastern Caribbean Deposit Insurance Corporation Agreement Bill 2025_ , part of a suite of harmonised legislation across the Eastern Caribbean Currency Union (ECCU) designed to bolster financial stability and protect depositors in the event of a bank failure.

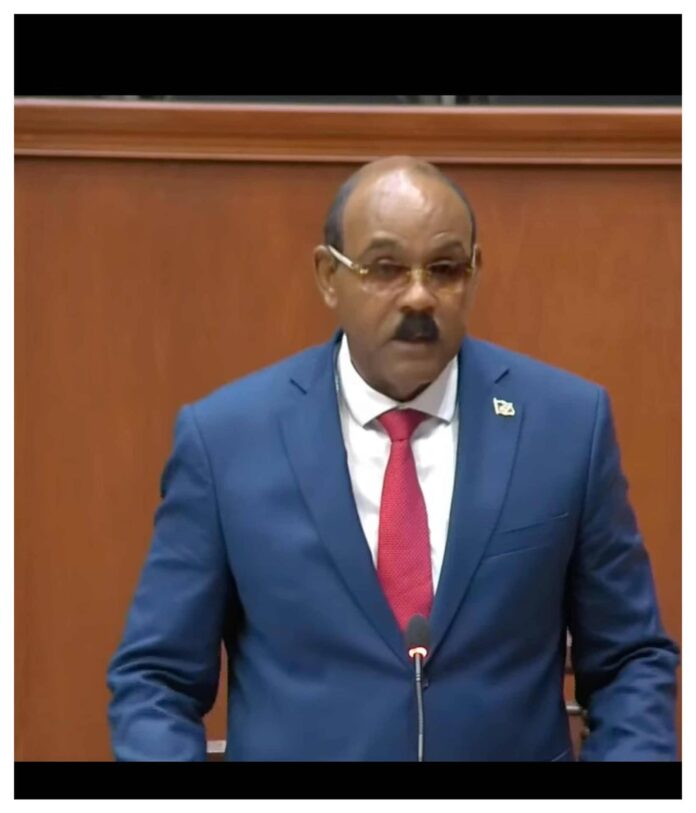

The bill was presented by Prime Minister Gaston Browne, who described it as a “landmark step” towards regional financial security. It paves the way for the establishment of the **Eastern Caribbean Deposit Insurance Corporation** , a regional body that will insure deposits of up to **EC $50,000** for individuals and businesses holding accounts at participating financial institutions.

“This will literally protect depositors in the event of a failed bank,” Prime Minister Browne told lawmakers. “All eight member states of the ECCU have agreed to this initiative. It is a critical layer of protection and a means of avoiding taxpayer-funded bailouts.”

According to Browne, the initiative will be funded primarily by premiums paid by financial institutions. While the precise methodology has yet to be finalised, he said banks may allocate a portion of the interest income from depositors to contribute to the insurance fund. An initial capital injection of **EC $1.5 million** will be provided by the Eastern Caribbean Central Bank (ECCB), with the fund expected to grow significantly over time.

Browne pointed to the region’s banking history as justification for the move, referencing past failures in Antigua and Barbuda, including **ABI Bank** , **Bank of Antigua** , and **Caribbean Union Bank (CUB)**. The Prime Minister said the government spent **EC $300 million** to protect depositors during the collapse of ABI Bank, a burden he argued should not fall on taxpayers again.

“This country suffered fiscal failure, economic failure, and bank failure all at once. No other country in the Caribbean has faced that trifecta. We must put systems in place to avoid repeating that history,” he said.

The bill also outlines a strong **governance and compliance structure** , with a five-member board to oversee the corporation’s operations. Non-compliant banks could face fines of up to **EC $500,000** , with additional daily penalties for continued violations. The ECCB will serve as custodian of the fund, managing deposits and investment returns under the guidance of the new corporation’s board.

Browne encouraged depositors with savings above the EC $50,000 threshold to diversify their holdings across multiple banks to ensure full coverage.

“There is a practical way to protect your full savings—split your funds between institutions,” he advised. He also noted that the coverage limit may be increased in the future if the fund grows significantly, possibly reaching **EC $100,000** or more.

The Prime Minister used the opportunity to clarify provisions in the bill regarding **legal immunity for officers and directors** of the corporation. He drew a parallel to recent controversy surrounding the government’s payment of legal fees in the _Alfa Nero_ matter, stating that indemnity clauses for public officials acting in good faith are standard in both national and international law.

“If we acted corruptly, there would be no immunity. But we acted in good faith and within our legal duties,” he said. “These provisions exist to protect those serving the public—not to shield wrongdoing.”

While Grenada is currently lobbying to host the headquarters of the new corporation, Browne said Antigua and Barbuda supports a collaborative approach, having previously hosted the Eastern Caribbean Asset Management Corporation (ECAMC).

The bill now awaits finalisation of similar legislation across the ECCU before the deposit insurance scheme can become operational.

“This is not just a financial instrument,” Browne concluded. “It is an expression of regional solidarity and a long-term investment in economic resilience.”