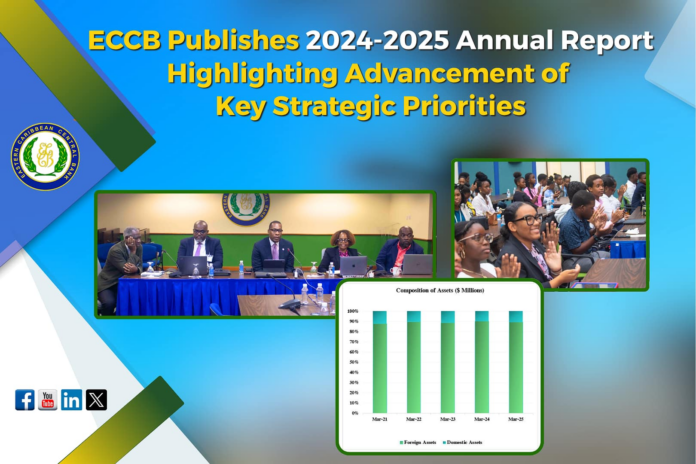

The Eastern Caribbean Central Bank (ECCB) has published its 2024-2025 Annual Report, which highlights the Central Bank’s efforts to maintain monetary and financial stability; promote financial inclusion and literacy; safeguard financial consumer protection; improve two-way engagement with stakeholders; and strengthen the governance of Citizenship by Investment Programmes (CBI/CIP).

“A Year of Implementation, Impact, No Excuses” was the guiding principle as the Bank executed its mandate for the 2024-2025 Financial Year, which ended 31 March 2025. The Bank’s foreign reserves grew and the backing of the EC dollar remained very strong. The ECCB recorded a net profit of EC$126.2 million for the year ended 31 March 2025 — the highest in the history of the Central Bank. This profit represents a 57.0 per cent increase over the previous record of $80.2 million achieved in 2024.

In pursuit of its mission to advance the good of the people of the Eastern Caribbean Currency Union (ECCU), maintain monetary and financial stability, and promote growth and development, the ECCB achieved several key strategic objectives as set out in its 2022 – 2026 Strategic Plan.

ECCB member countries began to enact the Banking Amendment Bill (2024), which the ECCB drafted to facilitate market conduct regulation and financial consumer protection for customers of Licensed Financial Institutions (LFIs) under the Banking Act (2015). Key provisions of the Bill include: (i) the establishment of a Basic Bank Account to make it easier for the unbanked and underserved to open bank accounts; and (ii) the establishment of the Office of Financial Conduct and Inclusion to support financial consumer protection and increase financial literacy.

In October 2024, the ECCB received approval from the Monetary Council for the establishment of the Eastern Caribbean Financial Standards Board (ECFSB). The ECFSB is a proposed integrated regulator that will provide microprudential regulation and financial consumer protection for the non-bank financial sector inclusive of credit unions and insurers in a partnership between the ECCB and national financial regulators. The ECCB is currently engaged in country consultations on the design elements of the ECFSB, as well as the finalisation of the Insurance and Pensions Bill and the establishment of Deposit Insurance.

In promoting financial inclusion and faster access to credit, the ECCB actively supported the operational launch of EveryData Credit Bureau in the ECCU through public education and awareness initiatives and regulatory oversight. In September 2024, Antigua and Barbuda became the first ECCB member country to officially go live on the ECCU credit bureau system, marking a critical milestone in the region’s credit reporting framework.

In his Foreword to the 2024-2025 Annual Report, Governor of the ECCB, Timothy N.J. Antoine, says the Bank continued to work to ensure the sustainability of the five CBI/CIP Programmes in the Eastern Caribbean Currency Union (ECCU), “given their importance to the fiscal and economic resilience of member countries.” The ECCB leads the Interim Regulatory Commission (IRC), a regional working group spearheading the establishment of an enabling CBI/CIP legal framework that is expected to become law by the end of 2025. The IRC, which the Governor currently chairs, has held consultations with key stakeholders in the CBI/CIP industry including government, leaders of opposition, local agents, developers, financial intelligence units, banks and international partners, such as the USA, UK and European Union.

The ECCB’s 2024-2025 Independent Auditors’ Report and Financial Statements are available on the Bank’s website and social media platforms.